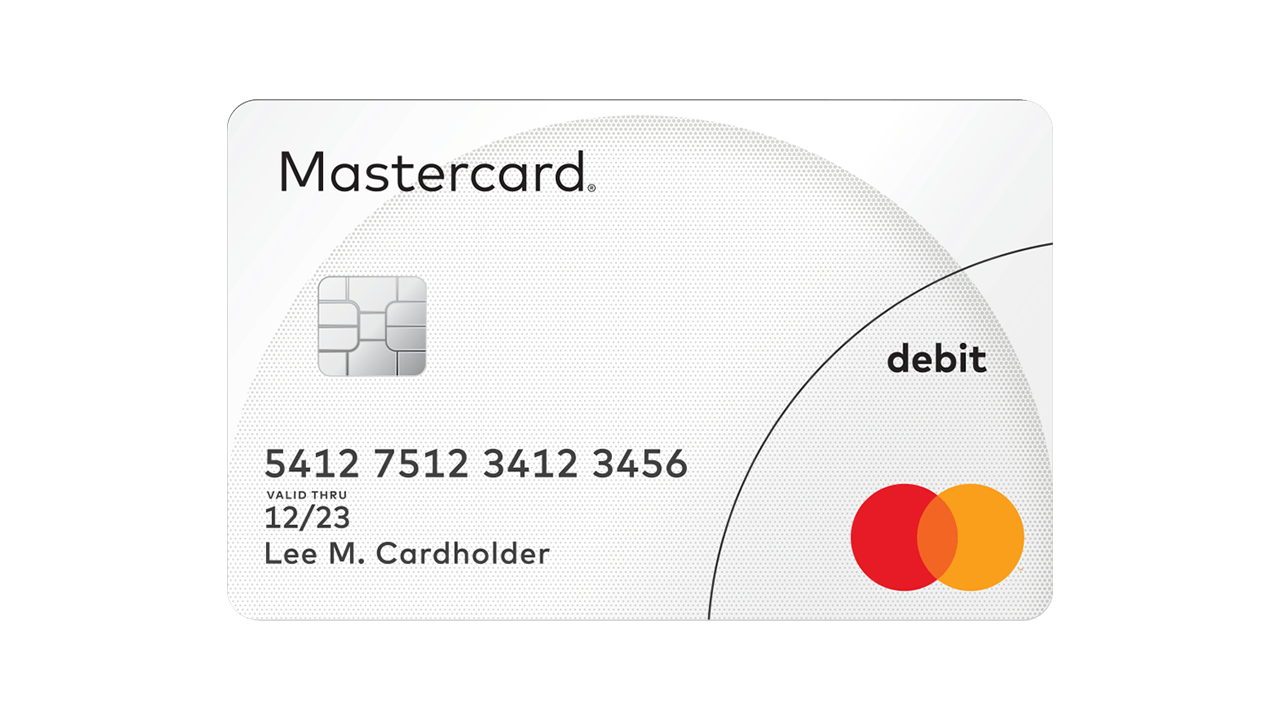

The credit card as it should be.

Without an annuity, it gives you cashback on all your purchases and access to months without interest.

What is a HDFC CREDIT CARD ?

An HDFC credit card is a type of payment card issued by HDFC Bank, one of the leading private sector banks in India. HDFC credit cards offer customers a convenient and flexible way to make purchases, both online and offline, and access credit facilities provided by the bank. Here are some key features and benefits of HDFC credit cards:

Payment Convenience: HDFC credit cards can be used to make payments for a wide range of goods and services at millions of merchant outlets worldwide, including retail stores, restaurants, online platforms, and more. Cardholders can enjoy the convenience of cashless transactions and the flexibility to pay for purchases over time through the credit facility offered by the bank.

Variety of Cards: HDFC Bank offers a diverse range of credit cards catering to different lifestyles, preferences, and spending habits. Whether you’re looking for rewards, cashback, travel benefits, entertainment privileges, or exclusive offers, HDFC credit cards come in various types and categories to suit your needs.

Rewards and Benefits: HDFC credit cards offer attractive rewards programs, allowing cardholders to earn reward points for every transaction they make using the card. These reward points can be redeemed for a variety of benefits, including cashback, discounts on purchases, travel vouchers, gift cards, and more. Additionally, HDFC credit cards may offer other benefits such as airport lounge access, concierge services, travel insurance, and dining privileges.

Interest-Free Period: HDFC credit cards typically come with an interest-free period, during which cardholders can make purchases without incurring any interest charges, provided they pay the outstanding balance in full by the due date. This feature allows cardholders to manage their finances more effectively and avoid unnecessary interest expenses.

EMI Options: HDFC credit cards may offer the option to convert large purchases into equated monthly installments (EMIs), allowing cardholders to spread out the cost of their purchases over time and make payments in more manageable installments.

Online Account Management: HDFC credit cardholders can easily manage their card accounts online through the bank’s internet banking portal or mobile app. They can view their card transactions, check their available credit limit, make bill payments, set up auto-payments, track reward points, and more, conveniently from their devices.

Security Features: HDFC credit cards are equipped with advanced security features to protect cardholders against fraudulent transactions and unauthorized use. These features may include EMV chip technology, two-factor authentication for online transactions, SMS/email alerts for transaction notifications, and the ability to set transaction limits and block/unblock the card instantly in case of loss or theft.

Overall, HDFC credit cards offer cardholders a host of benefits, rewards, and conveniences, making them a popular choice among consumers seeking a reliable and feature-rich payment solution. However, it’s essential for cardholders to use their credit cards responsibly, make timely payments, and manage their credit wisely to maximize the benefits and avoid incurring unnecessary debt.

Great Features Of HDFC CREDIT CARD

Online banking

Online banking, also known as internet banking or web banking, is an electronic payment system.

Up to 20.000$ limit

Online banking, also known as internet banking or web banking, is an electronic payment system.

Protection & security

Online banking, also known as internet banking or web banking, is an electronic payment system.

Mobile application

Online banking, also known as internet banking or web banking, is an electronic payment system.

Online Shopping

Online banking, also known as internet banking or web banking, is an electronic payment system.

Small payments fees

Online banking, also known as internet banking or web banking, is an electronic payment system.

Best Ways to Send Your Money From Anywhere You Like

PS Mudra came as a solution to the next generation. Through our portal, you can sit at the comfort of your home, office or pretty much anywhere, and send money to anywhere! Through our strong network.

Online Payments

We acceept many type payments getway that you love.

Safe Deposit

We acceept many type payments getway that you love.

Why You Choose Us?

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration.

Easy to Use

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration.

Faster Payments

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration.

100% Secure

There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration.

Choose Card

Considering Your Personal Needs

Want to know about our offers first?

Subscribe our newsletter

We're on a mission.

Welcome to PS Mudra, your trusted destination for hassle-free and accessible loan solutions. We understand that financial needs can arise unexpectedly, and finding the right loan option can be overwhelming. That’s why we are committed to providing a user-friendly platform and personalized services to help individuals and businesses find the perfect loan to meet their needs.

Help

- Address

- Anand Nagar Katra Near Becil Bhawan Church Basti UP 272001

- Customer Care

- +91 9084300986

.

.